Result description

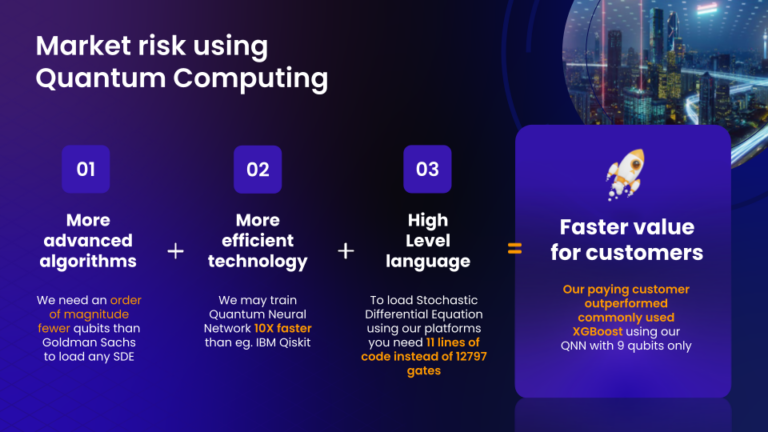

The key challange in terms of quantum software development is the fact of limited number of available qubits on current quantum hardware as well as the quality of the qubits caousing errors and noise. Therefore signigicant number of qubits is consumbed by error correction and mitigation algorithms. Having those reasons in mind, the fewer qubits are required for quantum algorithms the higher likelihood to execute it on available quantum hardware. Our algorithm requires significantly fewer qubits and outperforms solutions developed by even Tier 1 banks by order of magnitute. Additionally by leveraging our proprietary software platform, we can train and execute our models with exceptional efficiency. As a result, we have successfully built and trained models on quantum neural network at least 10 times faster than competitors in that niche.

Addressing target audiences and expressing needs

- Grants and Subsidies

- Business Angels

- Venture Capital

We are preparing to launch a funding round to support our transition from a Minimum Viable Product (MVP) to a scalable Quantum SaaS platform, enabling us to unlock new opportunities for growth and innovation.

- Public or private funding institutions

- Private Investors

R&D, Technology and Innovation aspects

We have a functional MVP of our solution, developed over the course of three years. Currently, we are focused on transforming the MVP into the first production-ready version of the product, suitable for deployment in real-world environments. In parallel, we are actively collaborating with well-established banks to commercialize our software and demonstrate its value in practical applications.

We aim to offer our solution as Quantum Software as a Service (QSaaS), enabling seamless scalability for additional customers at minimal incremental costs. By providing foundational building blocks for quantitative analysts, rather than delivering finalized models, which remain the property of the banks, we can efficiently scale our algorithms and software to meet the needs of new clients.

Our software and algorithms address a widespread challenge in the financial industry: the calculation and modeling of complex market risk scenarios and the pricing of multiple derivatives. Rather than solving a single, customer-specific problem, our solution is designed to tackle common issues faced by many users across the industry. By developing a scalable platform, we aim to deliver these capabilities to a broad range of customers efficiently and effectively.

Here’s an improved version:

The rising demand for computing power has significantly increased energy consumption, leading to a larger carbon footprint from data centers that rely on classical processors and GPUs, such as those from Nvidia. To address this challenge, we focus on developing quantum algorithms that can run on emerging quantum computers, which offer far greater energy efficiency compared to classical computing. By providing the financial industry with an alternative, energy-efficient solution for complex calculations, we aim to reduce the carbon footprint associated with the heavy computational demands of the sector

Result submitted to Horizon Results Platform by finQbit

Please

Please  Get instant access to tailored funding opportunities that perfectly match your needs. This powerful feature is exclusively available to our premium members—helping you save time, stay ahead of the competition, and secure the right funding faster.

Get instant access to tailored funding opportunities that perfectly match your needs. This powerful feature is exclusively available to our premium members—helping you save time, stay ahead of the competition, and secure the right funding faster. Curious about who’s viewing your listings? Unlock insights into your last 20 visitors and discover potential leads instantly!

Curious about who’s viewing your listings? Unlock insights into your last 20 visitors and discover potential leads instantly!