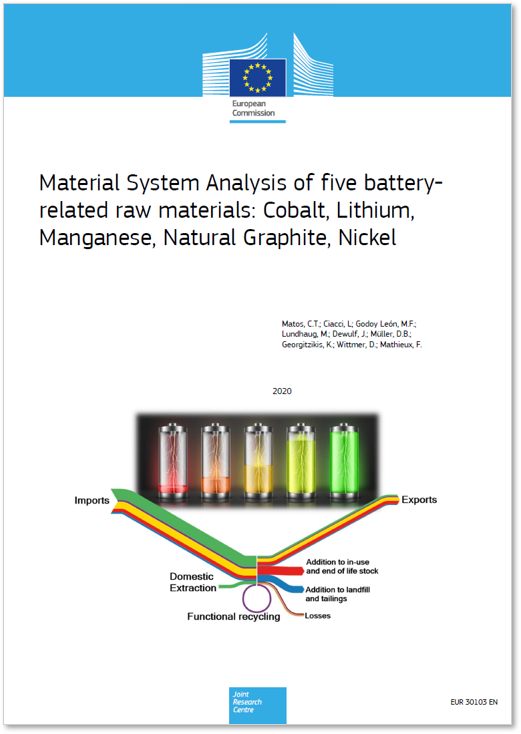

The transition to a climate-neutrality is expected to boost the demand for batteries in the coming years. If the EU wants to be competitive in the global market of battery manufacturing it has to ensure a sustainable, secure supply of raw materials needed for the batteries value chain. Therefore, reliable systemic information on recent availability of these raw materials within the EU economy is crucial to identify hotspots and define ways to secure their sustainable supply. Material System Analysis (MSA) can provide crucial information for the recent past on sustainable resource management, including the provision of evidence to inform policy decision-making on the sustainable and competitive supply of e.g. battery raw materials.

This report focuses on the MSA studies of five selected materials used in batteries: cobalt, lithium, manganese, natural graphite, and nickel. It summarises the results related to material stocks and flows for each material. The MSA studies, were performed for five consecutive reference years, i.e. from 2012 to 2016. This report however presents only the MSA results for 2016. Priority has been given to official and publicly available data sources. Because of their importance for the future battery value chain in Europe, the five MSA have been harmonised considering the latest available datasets publicly available on batteries stocks and flows (update from the ProSum database).

The five battery-related materials analysed show a very strong reliance on imports along the value chain. In particular the material systems are all highly dependent on imports of primary and/or semi-processed materials. The EU self-sufficiency was analysed separately for each stage. For the extraction stage, natural graphite had the lowest value of EU self-sufficiency in 2016 (less than 1% of the amount used in manufacturing was extracted in the EU), while nickel had the highest (37% of nickel in its primary forms was extracted in the EU). For the EU manufacturing stage, 75% of the products containing cobalt and lithium consumed in the use stage were produced in the EU, in 2016. On the other hand, the EU manufacturing of manganese, natural graphite and nickel products was self-sufficient to satisfy the EU consumption and supplying the external market.

For all these materials the functional recycling of old scrap is still low and under development in the EU. Cobalt has the highest end-of-life recycling input rate (EOL-RIR) with 22%, while for lithium, this rate is close to 0%. This indicates that the EU is currently able to only slightly decrease its dependency on primary material using secondary materials recycled domestically.

For the period covered by the MSA (2012-2016), results confirm that battery manufacturing has not been a dominant application. Based on the strong promotion of clean technologies, the demand for these raw materials is expected to multiply. As a consequence, imports of these materials will intensify, as domestic processing and manufacturing increases. The situation is however less clear for the net balance of the final products (containing these materials). In the coming years, the expansion in EU capacity to produce significant amounts of batteries and related final products will determine industry’s competitiveness on the world battery market.

Please

Please  Get instant access to tailored funding opportunities that perfectly match your needs. This powerful feature is exclusively available to our premium members—helping you save time, stay ahead of the competition, and secure the right funding faster.

Get instant access to tailored funding opportunities that perfectly match your needs. This powerful feature is exclusively available to our premium members—helping you save time, stay ahead of the competition, and secure the right funding faster.