Raw materials are essential to securing a transition to green energy technologies and for achieving the goals outlined in the European Green Deal. To meet the future energy demand through renewable energy sources, the power sector will face a massive deployment of wind and solar photovoltaic (PV) technologies. As a result, the consumption of raw materials needed to manufacture wind turbines and PV panels is expected to increase drastically in the coming decades. However, the EU industry is largely dependent on imports for many raw materials and in some cases is exposed to vulnerabilities in its supply. These issues raise concerns about the availability of some of the raw materials needed to meet the future deployment targets for the renewable energy technologies.

This study aims to estimate the future demand for raw materials for wind turbines and solar PV in various decarbonisation scenarios.

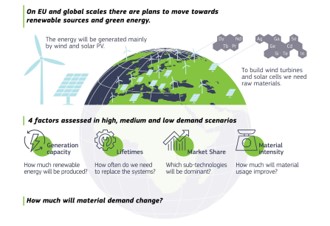

For the EU, the material demand trends were based on the EU legally binding 2030 targets and deployment scenarios aiming to achieve a climate-neutral economy by 2050. At global level, the generation capacity scenarios were selected based on various global commitments to limit greenhouse gas (GHG) emissions and improve energy efficiency.

In addition to power generation capacity, the material demand calculations took three more factors into account: the lifetime of the power plants, the market share of the sub-technologies and material intensity. By evaluating and combining these factors, three demand scenarios were built, characterised by low, medium and high material demands.

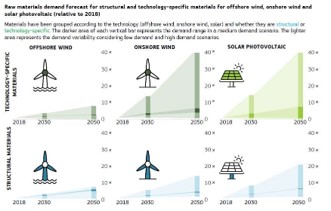

For wind turbines, the annual material demand will increase from 2-fold up to 15-fold depending on the material and the scenario. Significant demand increases are expected for both structural materials – concrete, steel, plastic, glass, aluminium, chromium, copper, iron, manganese, molybdenum, nickel and zinc – and technology-specific materials such as rare-earth elements and minor metals.

In the EU the biggest increase in material demand will be for onshore wind, with significantly lower variations for offshore wind, while on the global scale the situation is the opposite. The most significant example is that of rare earths (e.g. dysprosium, neodymium, praseodymium and terbium) used in permanent-magnet-based wind turbines. In the most severe scenario, the annual EU demand for these rare earths increases 6 times in 2030 and up to 15 times in 2050 compared to 2018 values. As a consequence, by 2050, the deployment of wind turbines according to EU decarbonisation goals alone will require most of the neodymium, praseodymium, dysprosium and terbium currently available to the EU market. In the high demand scenario, the global demand for rare earths in wind turbines could increase 8-9 times in 2030 and 11-14 times in 2050 compared to 2018 values, a slightly lower increase compared to the EU.

For solar PV technologies there are large differences in material demand between different scenarios, especially for those specific materials used in the manufacturing of PV cells. In the most optimistic case, improvements in material intensities could lead to a net decrease in material demand. In the medium demand scenario, the balance between capacity deployment and the material intensities will result in a moderate increase in demand ranging from 3 to 8 times for most materials. In the high demand scenario an increase in demand is expected for all materials, for example a 4-fold increase for silver and up to a 12-fold increase for silicon in 2050. For cadmium, gallium, indium, selenium and tellurium the change in the demand will be more significant, increasing up to 40 times in 2050. The highest demand in 2050 is expected for germanium, which might increase up to 86 times compared to 2018 values.

In the most severe conditions, the EU will require around 8 times (in 2030) and up to 30 times (in 2050) more structural materials, such as those used in frame and staffing materials, than in 2018. However, in the high demand conditions, the EU annual demand for PV cell materials varies more broadly, such as between 4 times for silver and 86 times for germanium in 2050. For silicon, the EU demand is expected to double in 2030 and increase 4 times in 2050 under the medium demand scenario, and increase 7 times in 2030 and 13 times in 2050 under a high demand scenario.

Considering both technologies, such high increases in material demand will put additional stresses on the future availability of some raw materials. The EU’s transition to green energy technologies, according to the current decarbonisation scenarios, could be endangered by weaknesses in future supply security for several materials, such as germanium, tellurium gallium, indium, selenium, silicon and glass for the solar PV and rareearth elements for the wind turbine technologies.