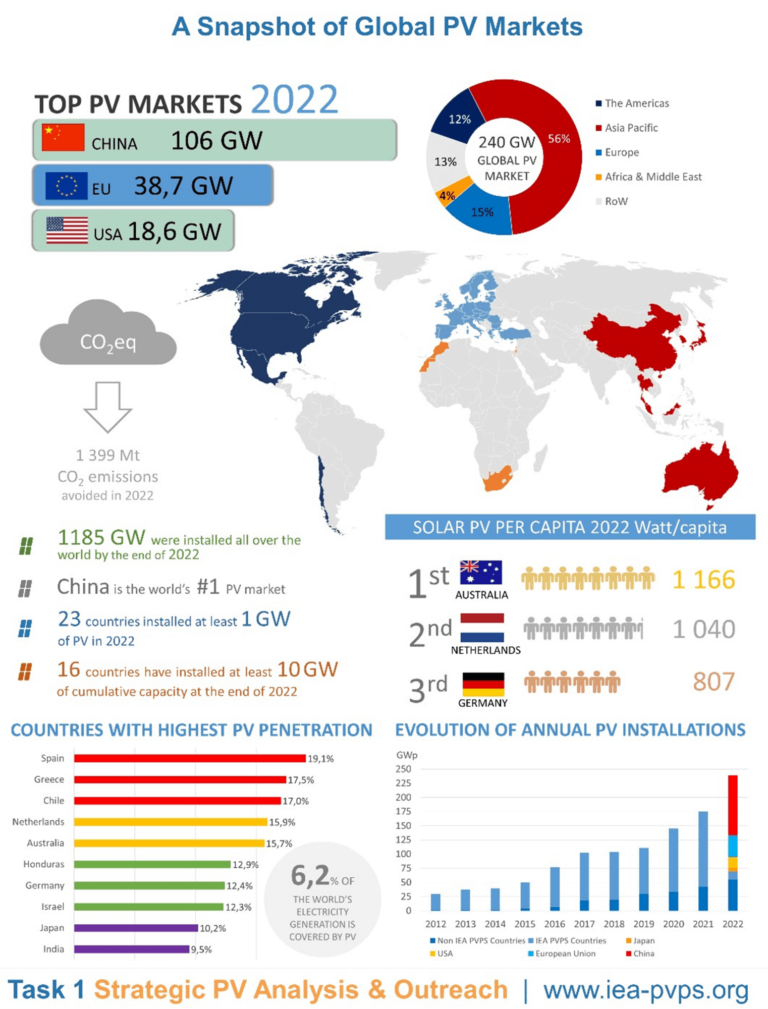

The global PV base once again grew significantly in 2022, reaching 1 185 GW (≈ 1,2 TW) of cumulative capacity according to preliminary market data, both despite and because of postcovid prices hikes and European geo-political strife. With 240 GW of new systems installed and commissioned, and nearly a dozen countries with penetration rates over 10%, (over 19% for Spain!), PV has demonstrated that it is a serious, major, long-term contributor to cost competitive electricity generation and emissions reductions of the energy sector.

Major trends include:

- The Chinese market continues to dominate both new and cumulative capacity and added 106 GW or 44% of new capacity to reach 414,5 GW of cumulative capacity, more than double that in Europe. This strong growth follows that of previous years – 54,9 GW in 2021 and 48,2 GW in 2020, and evenly balanced between centralised and distributed systems.

- Europe demonstrated continued strong growth with 39 GW installed, led by Spain (8,1 GW), Germany (7,5 GW), Poland (4,9 GW) and the Netherlands (3,9 GW). High electricity market prices have reinforced the competitivity of PV and several countries have acted policies to further accelerate PV in line with EU and national energy sovereignty engagements – whilst others are enacting policies to reduce injections because of grid congestion.

- The American market contracted to 18,6 GW under the combined influence of trade issues and grid connection backlogs, whilst Brazil installed a high 9,9 GW, nearly doubling the previous year’s new capacity.

- India once again showed strong growth with 18,1 GW, predominantly in centralised systems, and a PV penetration of nearly 10%. Strong volumes from Australia (3,9 GW despite supply chain issues), and Korea round out the regional market.

- Japan remained steady at 6,5 GW, the same as in 2021.

Nine countries now have penetration rates over 10% with Spain, Greece and Chile above 17%, and whilst grid congestion has become an issue, policy measures, technical solutions and storage are already providing workable solutions to enhance PV penetration.

Individual markets remain sensitive to policy support despite competitivity across most market segments in many countries, however policy support is moving to indirect measures such as accelerated permitting or facilitating prosumer models or managing grid congestion. Increasing concerns about the concentration of the upstream supply chain in China has led to initiatives and policy support for local manufacturing.

PV played an important role in the reduction of the CO2 emissions from electricity in 2022, with two-thirds of new renewable capacity installed in 2022, generating over 50% of generation from new renewable capacity and avoiding approximately 1 399 Mt of annual CO2 emissions, up 30% from 2021. This represents around 10% of the total electricity and heat sector emissions and 4% of all energy emissions. This continued positioning PV as one of the key existing and developing solutions to fight climate change here and now.