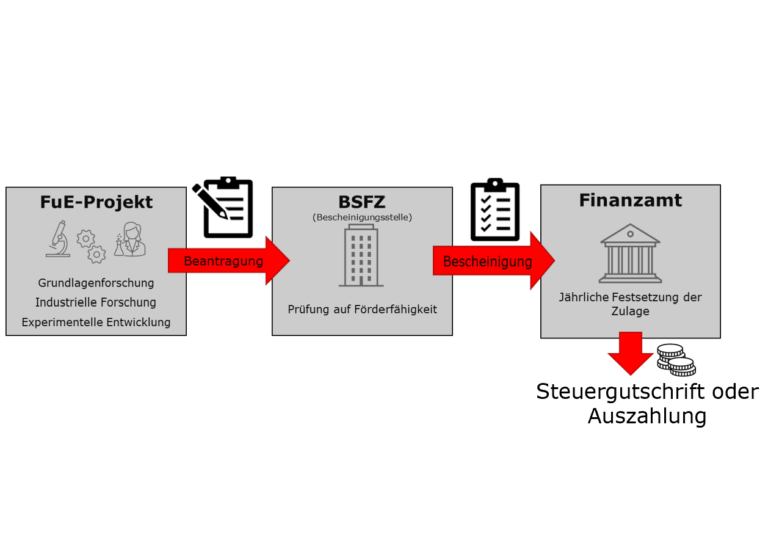

The Forschungszulage is a way to receive tax incentives for past, ongoing, or future development projects. Personnel costs incurred can be reimbursed up to 35%, commissioned research up to 17.5%, as well as a proportion of movable assets. To benefit from this, an application for the Forschungszulage must be submitted. This is reserved for companies that are taxable in Germany.

⚫🔴🟡German customers may benefit from access to Research Tax Credit when using our R&D services. Please contact us now for more information!