Study on the Critical Raw Materials for the EU (Final Report for 2023)

The European Union's assessment of Critical Raw Materials (CRMs) is a pivotal component of its Raw Materials Initiative (RMI), launched in 2008. This initiative was established to diversify the supply of non-energy raw materials, essential for the EU's industrial value chains and societal well-being. The RMI seeks to reduce dependencies by sourcing primary raw materials both from within the EU and third countries, increasing the supply of secondary raw materials through resource efficiency and recycling, and identifying alternatives to scarce raw materials.

Criticality of Raw Materials: The EU defines CRMs based on two primary criteria: high economic importance and high supply risk. The economic importance is assessed based on the value added of corresponding EU manufacturing sectors, adjusted by a substitution index. The supply risk is evaluated considering the global and EU supply concentration, governance performance, recycling, and substitution potential. The first CRM list, published in 2011, has been updated triennially to reflect changing circumstances.

Historical Overview: The CRM assessments conducted in 2011, 2014, 2017, and 2020 have seen a progressive increase in the number of materials identified as critical. Starting with 14 CRMs in 2011 out of 41 candidates, the list expanded to 30 CRMs out of 83 candidates by 2020.

Context of Current Assessment: The contemporary global landscape presents increasing pressure on resources due to factors like rising population, industrialization, digitalization, and demands from developing countries. The transition to climate neutrality also intensifies the need for metals, minerals, and biotic materials in low-emission technologies. Forecasts suggest a doubling of global material demand by 2060, indicating fierce competition for resources. In this context, the dependence on CRMs could become as significant as the current reliance on oil.

EU Industry and CRMs: Raw materials are foundational for the EU's industry, with CRMs playing a crucial role in products across strategic sectors such as renewable energy, digital technology, aerospace, and defense. These materials, though often used in small quantities, possess unique characteristics making them indispensable. Examples include rare earth elements in wind turbine magnets, lithium in batteries, and silicon in semiconductors.

EU Policies and CRMs: CRMs are key to fulfilling the objectives of various EU policies, including the European Green Deal, the REPowerEU Communication, and the Digital Strategy. These policies aim to drive the green and digital transitions while enhancing the EU's resilience and strategic autonomy. In 2022, the European Council's Versailles Declaration and the European Parliament resolution emphasized reducing dependencies and securing the CRM supply.

2023 Technical Assessment: The fifth technical assessment in 2023 evaluated 70 candidate materials, including 67 individual materials and three material groups. This assessment introduced four new materials and merged some for consistency. The results proposed 34 materials for the CRM list, with some new additions and others being dropped from the 2020 list.

Assessment Methodology: Developed in collaboration with the Ad hoc Working Group on Defining Critical Raw Materials, the methodology focuses on two main criteria: Economic Importance (EI) and Supply Risk (SR). The assessment uses specific thresholds for these criteria to determine the criticality of materials.

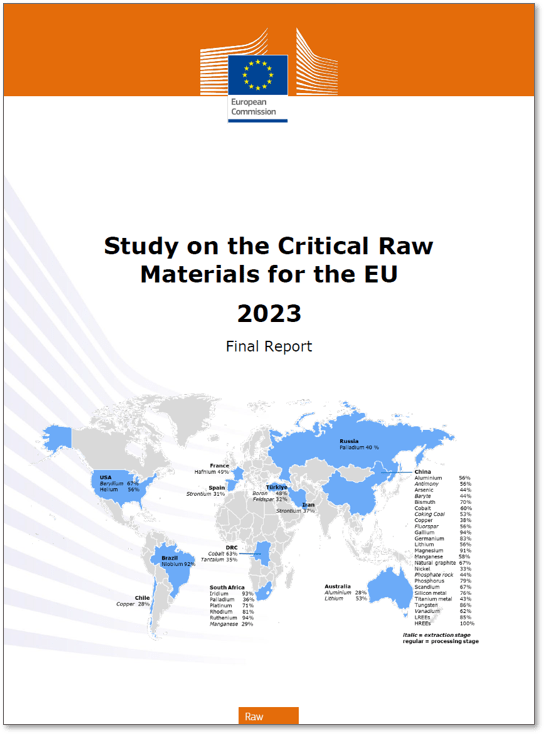

Global Supply Dynamics: China emerges as the predominant global supplier for several CRMs. The assessment also underlines the significant role of the EU in global CRM production, with notable contributions in various stages of CRM extraction and processing.

EU Sourcing of CRMs: The EU relies on several countries for CRM supply, with China being a major supplier for many. Other significant suppliers include countries like Chile, Guinea, Kazakhstan, Mexico, Norway, and the USA. However, the EU sourcing data lacks reliability for certain CRMs, highlighting a need for better trade data.

Circular Economy and Recycling: The EU has made strides in circular economy practices, notably in the recycling of some metals. However, for CRMs crucial in renewable energy and high-tech applications, secondary production remains limited.

Main Changes Since 2020: The 2023 assessment notes key changes compared to the 2020 assessment, including new CRMs being added, some being dropped, and adjustments in the assessment of materials like aluminium/bauxite and titanium metal. The dynamics in global supply and EU sourcing also reflect changes in the production and supply landscape.

Global and EU Supply Analysis: The assessment provides a detailed analysis of the global and EU supply landscape for CRMs. It includes the major global supplier countries, the main EU sourcing countries, and the shares of these countries in the supply of individual CRMs and material groups.

Strategic Importance of CRMs: The criticality assessment underscores the strategic importance of CRMs in the EU's industrial and technological landscape. With the growing demand for these materials, their secure and sustainable supply is crucial for the EU's economic and strategic objectives.

In summary, the EU's assessment of CRMs is an integral part of its strategy to ensure a secure, diversified, and sustainable supply of raw materials critical for its industries and technological advancements. The 2023 assessment reflects the evolving nature of these materials' criticality, influenced by global supply dynamics, technological developments, and EU policy objectives. The continued focus on CRMs is vital for the EU's ambition to maintain industrial leadership and strategic autonomy in a rapidly changing global environment.

Study on the Critical Raw Materials for the EU (Final Report for 2023) 0 reviews

Login to Write Your ReviewThere are no reviews yet.